-

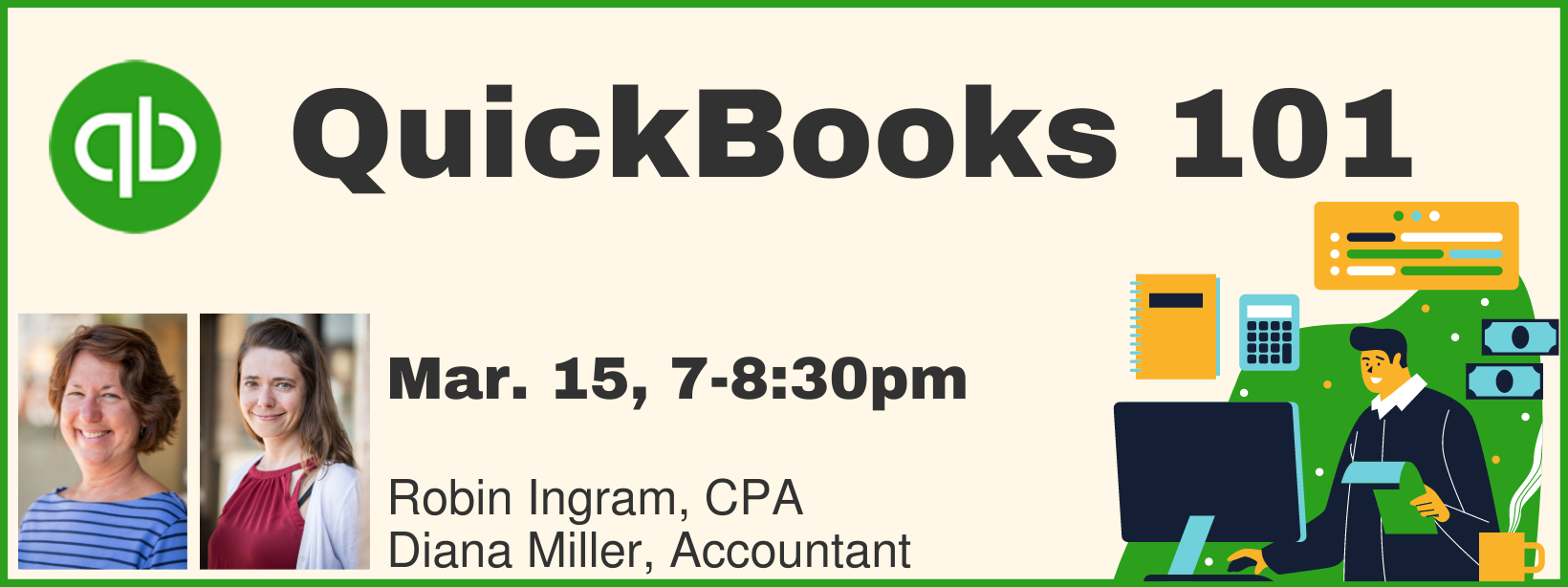

March 15, 2022

7:00 pm - 8:30 pm

This workshop is live online via Zoom. A recording will also be available to registrants to view at their convenience.

Did you recently begin using QuickBooks to track your personal, business, or congregation’s income and expenses? Or are you uncertain if QuickBooks is the right fit for you?

Join us to learn the basics of this widely-used accounting software. We will cover:

- Check and deposit entry

- Setting up a chart of accounts

- QuickBooks reporting options

- Bank reconciliations

QuickBooks 201, an intermediate workshop, will take place April 26. Sign up here.

Robin Ingram is a certified public accountant (CPA) with over 20 years of experience in public accounting, specializing in small business services including payroll, taxes, and the training and utilization of QuickBooks software. She is currently employed full-time by the School District of Lancaster as an accountant in the business office. Robin also works part-time with PRC’s bookkeeping. Robin is married and has two adult sons and attends LCBC.

Robin Ingram is a certified public accountant (CPA) with over 20 years of experience in public accounting, specializing in small business services including payroll, taxes, and the training and utilization of QuickBooks software. She is currently employed full-time by the School District of Lancaster as an accountant in the business office. Robin also works part-time with PRC’s bookkeeping. Robin is married and has two adult sons and attends LCBC.

Diana Miller works part-time for the Parish Resource Center as the accountant directly connecting with churches. She is employed in the accounting field and has over 10 years of accounting experience in both the non-profit and for-profit sectors. Diana has an extensive knowledge in QuickBooks including: setting up a chart of accounts, writing and printing checks, reconciling accounts, making journal entries, setting up budgets, creating customized reports, invoicing and making deposits.

Diana Miller works part-time for the Parish Resource Center as the accountant directly connecting with churches. She is employed in the accounting field and has over 10 years of accounting experience in both the non-profit and for-profit sectors. Diana has an extensive knowledge in QuickBooks including: setting up a chart of accounts, writing and printing checks, reconciling accounts, making journal entries, setting up budgets, creating customized reports, invoicing and making deposits.

Venue: Virtual Meeting Space